When hurricane season approaches, homeowners in storm-prone areas face more than just stocking up on supplies—they must ensure that their insurance policies are up to date and that their homes can pass rigorous inspections. These inspections aren't just formalities; they're essential to maintaining valid coverage and possibly even reducing your premium. If you live in a hurricane zone, being proactive about your insurance inspections and renewals could save you thousands of dollars—and a lot of headaches.

But what exactly do inspectors look for? How can you prepare your home to meet modern hurricane standards? And how does the renewal process work once your policy is set to expire? Read on as we break down every element of the hurricane insurance inspection and renewal process, so you can approach this hurricane season with confidence.

Understanding the Purpose of Hurricane Insurance Inspections

Insurance inspections are a critical component of maintaining hurricane coverage, especially in coastal or high-risk regions. These inspections assess the resilience of your home against severe weather events, and they allow insurance companies to determine the level of risk your property presents. While they might seem like a hassle, these evaluations can often help you qualify for significant discounts on your policy—provided your home meets certain structural criteria.

During an inspection, professionals will typically evaluate several structural and mechanical elements of your home. These include the type of roof you have, how it's secured, whether your windows are impact-rated or protected by shutters, and whether your doors are reinforced. If you live in a flood-prone area, the elevation of your property might also come under scrutiny. The higher and more secure your home is, the less likely it is to suffer damage, and the better your insurance rates will be.

Understanding what inspectors look for allows homeowners to be proactive. Before your inspection, consider hiring a contractor to assess your roof and reinforcements. It may be an investment, but the cost of upgrades is often offset by the long-term savings on your insurance premiums. Even small improvements—such as installing hurricane-rated garage doors—can positively impact your inspection results and overall coverage options.

Key Features Inspectors Look for in a Hurricane-Ready Home

Hurricane insurance inspections are comprehensive, and inspectors are trained to look for specific features that mitigate storm damage. One of the primary concerns is the integrity of your roofing system. Inspectors will check the age and material of your roof, the shape (hip roofs are more aerodynamic and therefore more desirable), and how it's attached to the structure below. Roofing features such as hurricane clips or straps that fasten your roof to the walls of your house are particularly valuable in high-wind conditions.

Another critical factor is window and door protection. Inspectors often assess whether your windows are made from impact-resistant glass or if they have secure storm shutters. Similarly, garage doors should be braced or rated to withstand wind pressures, as they are a common failure point during hurricanes. Entry doors are also evaluated for reinforcement and proper sealing against water intrusion.

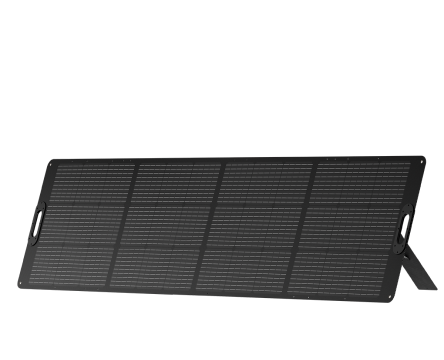

Beyond the obvious external features, inspectors also consider electrical systems, backup power solutions, and drainage infrastructure. Having a solar generator, such as one from OUPES, can demonstrate a serious commitment to off-grid readiness and power continuity. This kind of backup solution may not directly impact your insurance rate in all cases, but it certainly enhances your home’s overall storm resilience—and may give you a leg up when negotiating terms during renewal.

Steps to Prepare for a Successful Inspection

Being well-prepared before an inspector visits can save you both time and money. Start with a comprehensive visual inspection of your property. Are there any obvious vulnerabilities? Loose shingles? Cracked windows? Rusting storm shutters? Addressing these concerns proactively will increase the likelihood of passing your inspection with flying colors.

Documentation is equally important. Gather all records of upgrades and repairs—especially if you've recently replaced a roof, installed storm windows, or reinforced your garage door. Receipts, contractor certifications, and before-and-after photos can all support your case during an inspection. If you’ve installed alternative power systems like a solar generator, be sure to include the installation documents and any certification that proves it meets local safety standards.

It’s also wise to conduct a “mock inspection” with a qualified contractor. Many companies offer pre-inspection services that mimic the process insurance adjusters follow. These professionals can highlight areas of concern, make recommendations for improvement, and even help with minor repairs. This small investment often leads to big savings in the form of insurance discounts or premium reductions.

Understanding the Renewal Process and What Can Change

Hurricane insurance policies are typically renewed annually. As your renewal date approaches, your insurer may request a new inspection—especially if you've filed a claim in the past, or if changes to your property or local regulations have occurred. During this time, they’ll reassess your home’s condition and risk profile to determine if your premium should be adjusted or if any changes to coverage limits are necessary.

Policyholders should pay close attention to any correspondence from their insurer leading up to the renewal period. You may be required to submit updated documentation or schedule a follow-up inspection. Don’t delay in responding—failure to provide information in a timely manner can lead to lapsed coverage or reduced benefits.

One of the key changes during renewal is often related to rate adjustments. Premiums may rise if your property is deemed to have increased risk—whether due to aging infrastructure or changes in local storm activity. However, if you’ve made significant upgrades—like reinforcing your roof, installing impact windows, or adding a reliable solar generator system—you could be eligible for premium reductions or improved coverage terms. In some cases, you may even qualify for discounts under state-mandated wind mitigation programs, which further incentivize hurricane-resistant upgrades.

The Role of Backup Power in Insurance Evaluations

While backup power systems aren’t always mandatory for insurance coverage, they’re becoming increasingly important in the eyes of inspectors and insurers. With power outages becoming more frequent during hurricane events, homes with reliable backup power are better equipped to prevent damage, maintain safety, and recover more quickly. This matters not only for your own peace of mind but also in how insurance companies evaluate risk.

Solar generators, such as those provided by OUPES, offer a clean, quiet, and dependable power source during outages. These systems are especially valuable because they don’t rely on gasoline—which may be scarce during a crisis—and can be recharged by sunlight even if the grid remains offline for days. Installing a solar backup power solution may not only provide convenience but could demonstrate to insurers that you are minimizing your post-storm vulnerabilities.

In some areas, having a dependable backup power source might be the difference between maintaining coverage and losing it, especially if you live in a location with frequent outages. Even when not directly impacting your premium, this level of preparedness can make a strong case during policy renewal negotiations and could influence your claim success rate in the aftermath of a storm.

Conclusion: Be Proactive, Not Reactive

Preparing for hurricane insurance inspections and renewals isn’t just about checking a box—it’s a proactive strategy that safeguards your home, finances, and family. By understanding what inspectors look for and making thoughtful improvements, you can increase your home’s resilience, qualify for premium discounts, and ensure continuous, comprehensive coverage.

Take the time to assess your home, make necessary upgrades, and gather documentation well in advance of inspection and renewal periods. And don’t overlook the role of innovative solutions like solar generators. In storm-prone regions, showing that you’re ready for anything—even a prolonged power outage—can make a significant difference when it matters most.