Info comes from IRS*

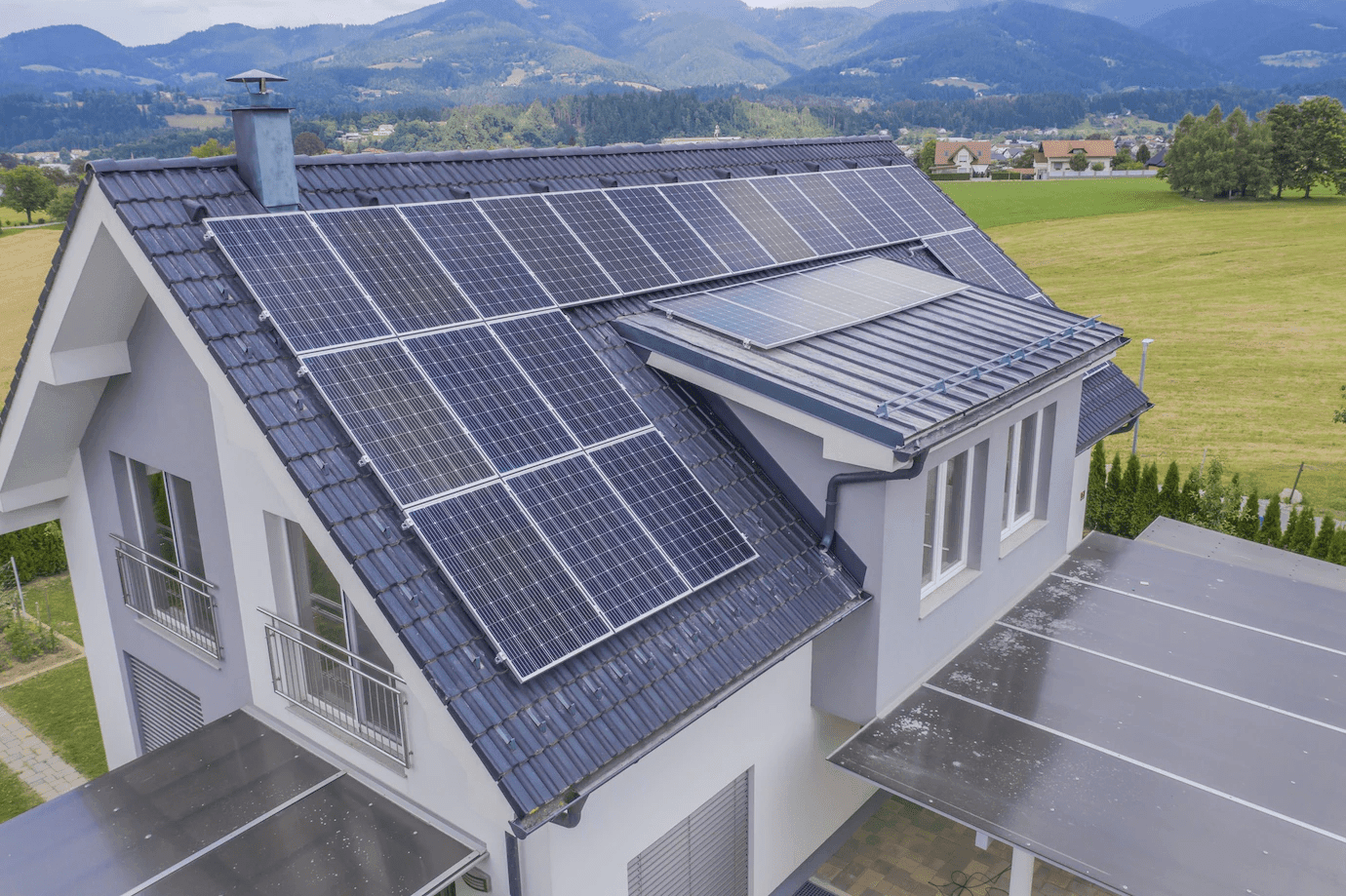

If you're a U.S. taxpayer looking to install a solar system in your primary home, the federal solar tax credit can potentially save you up to 30% on the current cost of the system. If you've already installed a system in 2022, consult your tax advisor to see if you qualify for an increased credit rate. Please note that the following discussion is subject to the disclaimer below. Read it carefully.

Our guide aims to help you determine if you can potentially save money on your solar system through the federal solar tax credit.

What is the federal solar tax credit?

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer. (Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.)

The installation of the system must be complete during the tax year.

Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30% for the installation of which was between 2022-2032. (Systems installed on or before December 31, 2019 were also eligible for a 30% tax credit.) It will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034. The tax credit expires starting in 2035 unless Congress renews it.

There is no maximum amount that can be claimed.

Am I eligible to claim the federal solar tax credit?

You might be eligible for this tax credit if you meet the following criteria:

1. Your solar PV system was installed between January 1, 2017, and December 31, 2034.

2. The solar PV system is located at a residence of yours in the United State.

3. Either:

You own the solar PV system (i.e., you purchased it with cash or through financing but you are neither leasing the system nor nor paying a solar company to purchase the electricity generated by the system). Or, you purchased an interest in an off-site community solar project, if the electricity generated is credited against, and does not exceed, your home’s electricity consumption. Notes: the IRS issued a statement (see link above) allowing a particular taxpayer to claim a tax credit for purchasing an interest in an off-site community solar project. However, this document, known as a private letter ruling or PLR, may not be relied on as precedent by other taxpayers. Also, you would not qualify if you only purchase the electricity from a community solar project.

4. The solar PV system is new or being used for the first time. The credit can only be claimed on the “original installation" of the solar equipment.

To learn more whether you eligible to claim the federal solar tax credit, check the full criteria listed by the U.S. Department of Energy and consult your tax advisor.

What expenses are included?

The following expenses are included:

1. Solar PV panels or PV cells (including those used to power an attic fan, but not the fan itself)2. Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees

3. Balance-of-system equipment, including wiring, inverters, and mounting equipment

4. Energy storage devices that have a capacity rating of 3 kilowatt-hours (kWh) or greater (for systems installed after December 31, 2022). If the storage is installed in a subsequent tax year to when the solar energy system is installed it is still eligible, however, the energy storage devices are still subject to the installation date requirement). Note: A private letter ruling may not be relied on as precedent by other taxpayers.

5. Sales taxes on eligible expenses

How to Claim the Federal Solar Tax Credit?

After seeking professional tax advice and ensuring you are eligible for the credit, you can complete and attach IRS Form 569 to your federal tax return (Form 1040 or Form 1040NR). Instructions on filling out the form are available here.

Disclaimer:

Please be advised to consult a tax professional to determine your eligibility for tax credits based on your individual circumstances. Oupes does not provide any guarantee of tax credits associated with our products. The information we provide is solely for educational purposes and should not be considered legal advice. It does not constitute professional tax advice or financial guidance. It is recommended to seek advice from a tax professional for evaluating your eligibility.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.